Using EON method for Stock Profiling

Someone recently posted a search for “Seasonal Cycles and Elemental Influences on Stocks.” I’d assume he or she was checking out my past articles on applying the Elements of Numbers (EON) method for stock investment, and my workshop conducted in 2015. I’ve also shared my observations during the workshop, using EON tendency signs, on the unlikely possibility of a stock market crashed that many analysts have predicted to happen in 2016.

Every year, the periodic energies are influencing us, and it could affect us in changing ways, depending on where we stay, the country’s political and economic situations, life experiences, and our physical, mental, and holistic health states. Similarly, there are cyclic and seasonal patterns observed by professional stock investors and financial investment book authors.

Every year, the periodic energies are influencing us, and it could affect us in changing ways, depending on where we stay, the country’s political and economic situations, life experiences, and our physical, mental, and holistic health states. Similarly, there are cyclic and seasonal patterns observed by professional stock investors and financial investment book authors.

Before I continue, let me clarify that I’m not a stock investment person relying only on popular time-tested, technical charting techniques. I’m more of a casual investor who took action when the budget permits, and don’t believe in putting “all eggs in one basket” even though temptations to put extra more money in one basket, at times, could be felt. Haha, discipline is important. My observations are complemented by applying the Elements of Numbers (EON) method. I’ve attended courses on investment and learned the popular technical indicators and charting techniques. Yes, my humble stock portfolio has increased. I’ll be candid with you – there were hits and misses; I’m glad my overall stock investment portfolio today has shown positive returns, amidst current unprecedented public health crisis and COVID-19 pandemic uncertainties.

Even financial experts have changed their forecast more often this year than before. Some time-tested financial investment theories were “not applicable” suddenly, due to the pandemic crisis. These resulted in uncertainties and fear, and creating unnecessary negative sentiments. The stock investment portfolio of Warren Buffet and others have been affected too. Still, there are people who aren’t afraid to check the dark clouds searching for the silver linings, often filled with opportunities.

From an EON perspective, I’m finding out potential stocks based on the year energies. Do check out my “Numerological Predictive Observations” (NPO) articles. For instance, I mentioned about “healthcare” and “medical services” being in focus this year in my NPO2020 article. There are many components in healthcare and medical services – from the manufacturing supply chain (like masks, gloves, personal protective gears, syringes, sanitisers, and cleaning agents) to logistics (transportation, ambulances, wheelchairs), to pharmaceutical outlets (vaccines, medicines, and prescription drugs). Over the past few months, the stock price of one SGX-listed company manufacturing gloves had risen exponentially this year. Elsewhere, stock prices of some biotechnology companies listed in NASDAQ have also gone up, especially those that are currently conducting the trial tests on potential COVID-19 vaccines.

From an EON perspective, I’m finding out potential stocks based on the year energies. Do check out my “Numerological Predictive Observations” (NPO) articles. For instance, I mentioned about “healthcare” and “medical services” being in focus this year in my NPO2020 article. There are many components in healthcare and medical services – from the manufacturing supply chain (like masks, gloves, personal protective gears, syringes, sanitisers, and cleaning agents) to logistics (transportation, ambulances, wheelchairs), to pharmaceutical outlets (vaccines, medicines, and prescription drugs). Over the past few months, the stock price of one SGX-listed company manufacturing gloves had risen exponentially this year. Elsewhere, stock prices of some biotechnology companies listed in NASDAQ have also gone up, especially those that are currently conducting the trial tests on potential COVID-19 vaccines.

Today’s article is about sharing techniques from a non-technical, non-traditional investment perspective. As what I’ve shared at the stock workshops previously, I’m complementing the investment analysis by identifying the cyclic energies of the year, and its influencing effects on stocks. For example, next year 2021 is about communication and transportation, and movement of metals and medicines. It’s like an extension of this year’s 2020 energies. And when we interpret the 2021 as 2+2+1=5, it also about constructions and food industries – the rebuilding and construction works, and the revitalising of our gastronomic delights. Could the year 2021 bring positive signs of COVID-19 vaccines and extensive medical distributions worldwide? And the renewal of food outlets and eateries too? Yes, there are huge potentials in these industries. It’s a common-sense equation when you look from a post-pandemic perspective. And what’s more – with increasing people binge drinking and consuming a sugar-rich and starchy diet, it could eventually raise the statistical numbers of people suffering from diabetic-like symptoms as well. Hmm… stock prices of biomedical companies producing medicines for diabetes, might potentially, be “in focus” too.

Today’s article is about sharing techniques from a non-technical, non-traditional investment perspective. As what I’ve shared at the stock workshops previously, I’m complementing the investment analysis by identifying the cyclic energies of the year, and its influencing effects on stocks. For example, next year 2021 is about communication and transportation, and movement of metals and medicines. It’s like an extension of this year’s 2020 energies. And when we interpret the 2021 as 2+2+1=5, it also about constructions and food industries – the rebuilding and construction works, and the revitalising of our gastronomic delights. Could the year 2021 bring positive signs of COVID-19 vaccines and extensive medical distributions worldwide? And the renewal of food outlets and eateries too? Yes, there are huge potentials in these industries. It’s a common-sense equation when you look from a post-pandemic perspective. And what’s more – with increasing people binge drinking and consuming a sugar-rich and starchy diet, it could eventually raise the statistical numbers of people suffering from diabetic-like symptoms as well. Hmm… stock prices of biomedical companies producing medicines for diabetes, might potentially, be “in focus” too.

As mentioned earlier, the construction industries could be “in focus” late this year and next year. This is in view of the tendency signs suggesting strong likelihood of severe flood, thunderstorms, fearful lightning strikes, and heavy snow later this year (due to the transitioning Year 2021/2022 energies). Oh, understanding the transitioning and seasonal influences could help you to identify the potential ups and downs period affecting product demands and stock prices.

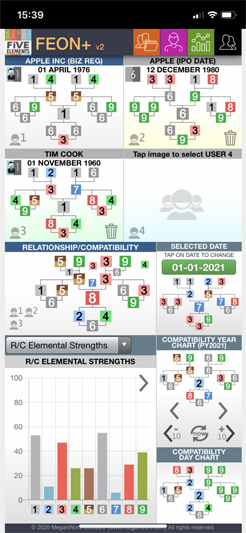

I’ve put on hold my research on stocks profiling beyond identifying the industries in focus. As identifying specific industry is overly general, there is the need to zoom in and conduct a macro-analysis on potential stocks related to the identified industry. It was a time-consuming process for me to consolidate all essential information. For instance, you need to conduct multiple macro-analysis on the various stocks, and include the CEO’s birthdate as well. I’d recommend you to include the company’s business registration date (if available) and/or official IPO date too. This is similar to plotting a person’s chart. When you include the CEO’s birthdate, you can check the Relationship/Compatibility Chart of the partnership – the CEO leadership abilities toward achieving the company’s mission and profits. Once these essential charts are available, you can then check on the tendency signs present in the Compatibility Year Chart.

I’ve put on hold my research on stocks profiling beyond identifying the industries in focus. As identifying specific industry is overly general, there is the need to zoom in and conduct a macro-analysis on potential stocks related to the identified industry. It was a time-consuming process for me to consolidate all essential information. For instance, you need to conduct multiple macro-analysis on the various stocks, and include the CEO’s birthdate as well. I’d recommend you to include the company’s business registration date (if available) and/or official IPO date too. This is similar to plotting a person’s chart. When you include the CEO’s birthdate, you can check the Relationship/Compatibility Chart of the partnership – the CEO leadership abilities toward achieving the company’s mission and profits. Once these essential charts are available, you can then check on the tendency signs present in the Compatibility Year Chart.

The number 6 is not the only number we could associate with money. In extended EON theories, there are other numbers that we could associate with money or financial wealth. When you noticed multiple manifestations of such “monetary” numbers, it could denote stronger vibrations and movement of the energies. Whether to sell and take profits, or to wait for a little longer to catch even more profits, is a choice you can then decide.

It is easy to collect the stock data histories, and the IPO or business registration dates. However, it might be a little harder to know the CEO’s birthdate as few companies provided the CEO’s birth details on their official websites or annual reports. Unless you have easily access to the data, it is not easy to zoom in the potential stock to invest in, even if you’ve already identified the type of industry to be in focus on a particular year.

That’s the primary reason why I didn’t pursue further on a more aggressive way to do research on stocks profiling, including developing a unique EON Stock software. I’m currently applying basic EON techniques to identify potential stocks to invest; I’m doing more for long-termed goals, and collecting dividends whenever possible.

I hope I’ve shared some insights on how you can identify potential industries that might get into focus next year. With the uncertainties today, come opportunities tomorrow to those who seek. If you’re keen to explore using the EON method for stock profiling and investment, it might be an opportune time for you to list down the stocks from the industries that I’ve mentioned. You can then utilise your investment knowledge to determine the ideal stock to invest.

As in any stock investment precautionary statements, you’re solely responsible for your personal judgement and decision made. Always remember the DYODD stock advice – Do Your Own Due Diligence.

After conducting the workshop on “Seasonal Cycles and Elemental Influences on Stocks” in 2015, I noted there are external numerology trainers sharing similar methods with their students on stock investment techniques. I’m glad they’re applying the techniques that I’ve mentioned again in this article, which have worked well for them too. In many ways, the approaches that I’ve depicted in this article, is still applicable and relevant for basic stock profiling. Beyond that, you have to apply the existing investment and charting techniques to decide the best stock pick.

Lastly, I’d not suggest you to put all your money in one basket, that is, not to invest all your spare cash on stocks and shares. There is always the potential element of risk like losing substantial portion in stock investment, during uncertainty periods and/or investors’ manipulations. For instance, with the current COVID-19 pandemic and regular wild remarks made by politicians, these could inadvertently influence the bulls and bears on market rallies affecting stock prices.

Lastly, I’d not suggest you to put all your money in one basket, that is, not to invest all your spare cash on stocks and shares. There is always the potential element of risk like losing substantial portion in stock investment, during uncertainty periods and/or investors’ manipulations. For instance, with the current COVID-19 pandemic and regular wild remarks made by politicians, these could inadvertently influence the bulls and bears on market rallies affecting stock prices.

Spread out your surplus wealth in other baskets (areas) too, like investing in yourself through skills upgrading, maximising the time to learn new skills, pursues a hobby, start a new project; or contributes to charitable organisations. Whatever it is, the effort taken today will reward you with the knowledge, experience, and confidence, to face future challenges.

Regards, Ron WZ Sun